Different Methods of determining depreciation:

Now we are going to discuss methods of determining depreciation and before that let us know what actually depreciation is.It is due to constant use of power plant equipment and building for many years there is a decrease in value of power plant.This is called depreciation of power plant.

If the power station equipment were to last for ever, then interest on the capital investment would have been the only charge to be made.However, in actual practice, every power station has a useful life ranging from fifty to sixty years.From the time the power station is installed, its equipment steadily deteriorates due to wear and tear so that there is a gradual reduction in the value of the plant.This reduction in the value of plant every year is known as annual depreciation.

Due to depreciation, the plant has to be replaced by the new one after its useful life.Therefore, the suitable amount must be set aside every year so that by the time the plant retires, the collected amount by way of depreciation equals the cost of replacement.It becomes obvious that while determining the cost of production, annual depreciation charges must be included.There are several methods of determining annual depreciation charges and are discussed here below:

Methods of determining depreciation:

There is a reduction in the value of the equipment and other property of the plant every year due to depreciation.Therefore, a suitable amount (known as depreciation charge) must be set aside annually so that by the time the life span of the plant is over, the collected amount equals the cost of replacement of the plant.

Must Read:

The following are the commonly used methods for determining the annual depreciation charge :

(i) Straight line method

(ii) Diminishing value method

(iii) Sinking fund method

(i) Straight line method: In this method, a constant depreciation charge is made every year on the basis of total depreciation and the useful life of the property.Obviously, annual depreciation charge will be equal to the total depreciation divided by the useful life of the property.Thus, if the initial cost of equipment is Rs 1,00,000 and its scrap value is Rs 10,000 after a useful life of 20 years, then,

In general, the annual depreciation charge on the straight line method may be expressed as :

where P = Initial cost of equipment

n = Useful life of equipment in years

S = Scrap or salvage value after the useful life of the plant.

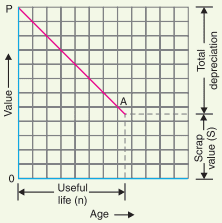

The straight line method is extremely simple and is easy to apply as the annual depreciation charge can be readily calculated from the total depreciation and useful life of the equipment.The figure below shows the graphical representation of the method.It is clear that initial value P of the equipment reduces uniformly, through depreciation, to the scrap value S in the useful life of the equipment.

The depreciation curve (PA) follows a straight line path, indicating constant annual depreciation charge.However, this method suffers from two defects.Firstly, the assumption of constant depreciation charge every year is not correct.Secondly, it does not account for the interest which may be drawn during accumulation.

(ii) Diminishing value method: In this method, depreciation charge is made every year at a fixed rate on the diminished value of the equipment.In other words, depreciation charge is first applied to the initial cost of equipment and then to its diminished value.As an example, suppose the initial cost of equipment is Rs 10,000 and its scrap value after the useful life is zero.If the annual rate of depreciation is 10%, then depreciation charge for the first year will be 0·1 × 10,000 = Rs 1,000.

The value of the equipment is diminished by Rs 1,000 and becomes Rs 9,000.For the second year, the depreciation charge will be made on the diminished value (i.e. Rs 9,000) and becomes 0·1 × 9,000 = Rs 900.The value of the equipment now becomes 9000 − 900 = Rs 8100.For the third year, the depreciation charge will be 0·1 × 8100 = Rs 810 and so on.

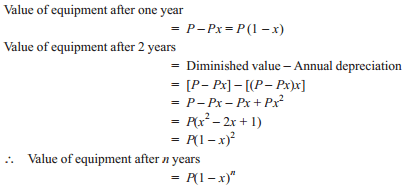

Mathematical treatment:

Let P = Capital cost of equipment

n = Useful life of equipment in years

S = Scrap value after useful life

Suppose the annual unit depreciation is x.It is desired to find the value of x in terms of P, n and S.

But the value of equipment after n years (i.e., useful life) is equal to the scrap value S.

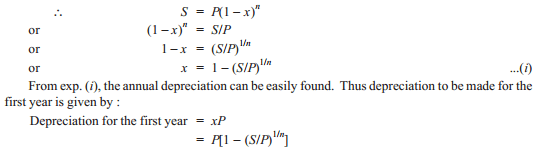

Similarly, annual depreciation charge for the subsequent years can be calculated.This method is more rational than the straight line method.The figure below shows the graphical representation of diminishing value method. The initial value P of the equipment reduces, through depreciation, to the scrap value S over the useful life of the equipment.The depreciation curve follows the path PA.

It is clear from the curve that depreciation charges are heavy in the early years but decrease to a low value in the later years.This method has two drawbacks.Firstly, low depreciation charges are made in the late years when the maintenance and repair charges are quite heavy.Secondly, the depreciation charge is independent of the rate of interest which it may draw during accumulation.Such interest money, if earned, are to be treated as income.

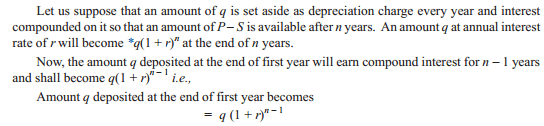

(iii) Sinking fund method: In this method, a fixed depreciation charge is made every year and interest compounded on it annually.The constant depreciation charge is such that total of annual instalments plus the interest accumulations equal to the cost of replacement of equipment after its useful life.

Must Read:

Let P = Initial value of equipment

n = Useful life of equipment in years

S = Scrap value after useful life

r = Annual rate of interest expressed as a decimal

Cost of replacement = P − S

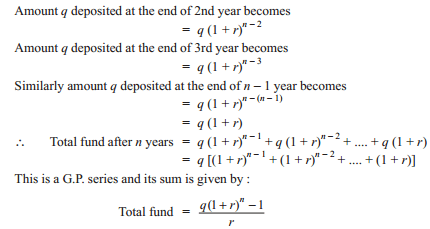

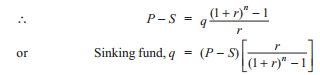

This total fund must be equal to the cost of replacement of equipment P − S.

The value of ‘q’ gives the uniform annual depreciation charge.The parenthetical term in eq. (i) is frequently referred to as the “sinking fund factor”.

Though this method does not find very frequent application in practical depreciation accounting, it is the fundamental method in making economy studies and most effective method of determining depreciation.